ATLANTA — While tariff woes and slower spring selling seasons kept some outdoor retailers at home last week, many exhibitors at Casual Market Atlanta — particularly those with domestically made product — reported solid traffic.

“We’ve been really busy,” said Leisa McCollister, vice president of marketing, OW Lee. “I think it’s partly that we’re American-made and that we’re family owned and stable.”

OW Lee rolled out several new collections and pieces at market designed to offer a more competitive price point for buyers looking for domestic sources to replace imported lines.

“The Nova firepit is similar to other firepits in our line, but it’s more streamlined to hit an opening price point,” McCollister said.

OW Lee had plenty for its higher-end buyers, as well, including the sleek Horizon collection featuring angular midcentury-modern lines and plush cushions.

Other domestic manufacturers reported a similar experience during Casual Market, as buyers sought alternatives to imports in an attempt to avoid the tariffs imposed by the Trump administration. And throughout AmericasMart, exhibitors touted their American-made products to entice new customers.

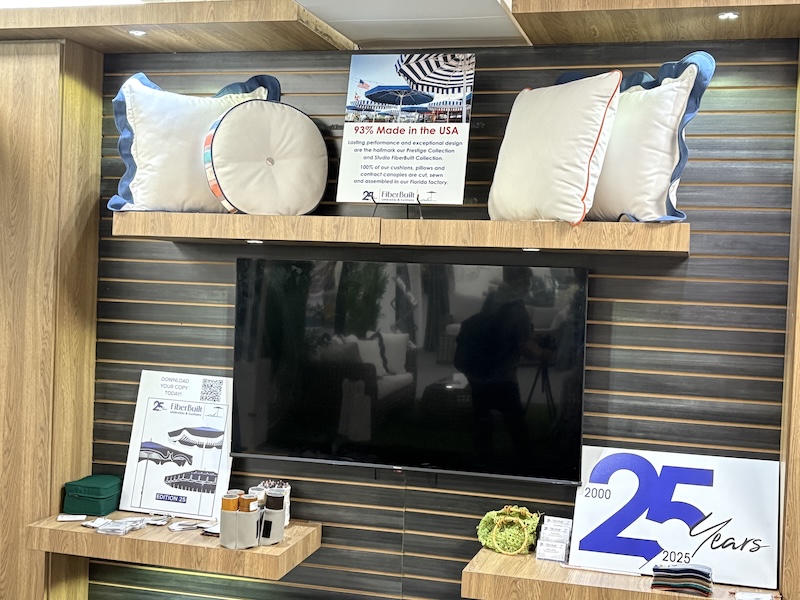

“We’ve had buyers come to us and say, ‘We’re tired of all this tariff stuff — they’re changing every day,’” said Paul Knapp, CEO, FiberBuilt Umbrellas, which is based in Florida. “We’re 93% made in the U.S., and we have a container program — the labor, distribution, sewing, everything other than a few components are made here. That’s a good advantage to have now.”

In their booth on the temporary floor, FiberBuilt displayed signs touting their domestic capability to produce on-trend shade products. Knapp said foot traffic was good during the show.

Kait Warren, vice president of marketing at Telescope Casual, said she’d rarely seen their showroom as busy as it was during Casual Market, with visitors flooding the space all day long. Warren said the company, which produces its furnishings in upstate New York, shifted some of its offerings prior to market to eliminate the use of imported components.

“For a long time we’ve had the Tribeca sling collection, which had some imported components. That doesn’t really align with our values or how we produce, so we decided to drop that line, especially with all the tariff uncertainty,” she said. “So we dropped the line and introduced our Soho sling collection, which has more of a sweeping design and wraparound back that adds a lot of value for a piece at the mid- to lower end of our line.’

On the higher end, Warren said Telescope’s new Antero collection was a big hit with marketgoers, with its almost-fully marine-grade polymer frame providing a striking chair back look even with cushions.

“When you walk onto someone’s patio, you often see the back of a chair first, so offering this really attractive back was important for us this year,” she said.

Chair backs made a statement at Florida-based Tropitone, too, where President Frank Verna said traffic was brisk to see their new Orbit collection — with rounded lines that popped in a white finish against deep blue cushions.

“It has very unique lines and a lot of aluminum, so it’s a very heavy swivel chair,” Verna said. “It has been really well-received.”

Lane Venture also had a busy market, buoyed by its launch of fabric options from the new Sunbrella x Block Shop collection and a spate of domestically made products that offered options for buyers who want to avoid tariffs.

“Being 45% domestic, that helps, and some of our factories made strategic moves that put us in a position that we didn’t have to raise prices even with some of our inputs,” said Schon Duke, vice president, Lane Venture. “So when we were setting up our showroom, we knew we needed to put our American craftsmanship story out there.”

That story includes the company’s custom program, Bespoke, which allows customers to choose from an assortment of backs, arm styles, finishes and fabrics to create their own look. Fully upholstered outdoor pieces also play a key role, with Lane Venture taking advantage of parent company Bassett’s upholstery facility in North Carolina to expand its offerings of seating designed to look and feel like indoor furniture while standing up to the rigors of outdoor use.

“Upholstery is our third-bestselling category,” Duke said. “People have really leaned into this product.”

Duke said Bassett’s investment in a facility in Haleyville, Alabama, also gives Lane Venture aluminum production capability, which has benefited the company since tariffs came into effect.

With tariff policies in flux as some of the reprieves President Donald Trump issued are set to expire soon, Casual Market Atlanta’s two-show cadence feels particularly advantageous. Retailers and manufacturers reliant on imports hope to see some resolution by the fall show — set for Sept. 15-18 — and domestic makers see the second market as another opportunity to reach buyers looking for tariff-proof alternatives.

“This summer offering is a vital component of our full-year strategy for Casual Market Atlanta,” said Scott Eckman, president of Andmore. “We’re encouraged by the strong turnout and steady engagement across permanent showrooms, and we’re seeing excitement ramping up toward fall. Together, these two markets offer valuable opportunities for the industry to stay connected, source new product and plan with purpose.”