Blackford Capital is making huge moves in the outdoor industry. Just look at its past two years.

In November 2022, the firm started its Patio Portfolio Platform by acquiring Starfire Direct, a major e-commerce retailer of outdoor furnishings. Less than a month later, the company announced the acquisition of Artificial Turf Supply.

Blackford then acquired LTD Online Stores, which includes well-known outdoor brands Patio Productions and Harmonia Living, in December 2022. Just a few weeks ago, the firm announced it had acquired Empire Distributing to expand its operations and goal of providing full product breadth with outdoor living and hearth items.

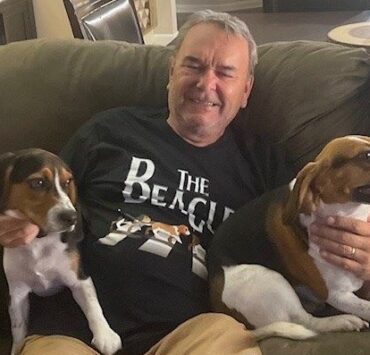

It’s obvious the company has been investing substantially in the outdoor category, and now it has hired John Snowden as CEO of the Patio Consolidation Platform — representing the entire group of outdoor-related brands.

With an extensive background in driving successful operations, strategic acquisitions and digital transformation, Snowden will spearhead Blackford’s vision to “Own the Backyard” by building a comprehensive, omnichannel platform that capitalizes on the booming outdoor living market.

Snowden brings over three decades of leadership experience, including roles as CEO at Recom and CEO of Trademark Global LLC. His proven track record includes transforming midmarket companies into powerhouse brands through data-driven insights, supply chain optimization and successful integrations of multiple acquisitions.

Under his leadership, Blackford’s Patio Platform will focus on expanding its product portfolio and leveraging digital and traditional distribution channels to create a one-stop solution for outdoor living needs.

“We’re thrilled to welcome John Snowden as the CEO of our Patio Consolidation Platform. A man of great character, his vision and commitment to operational rigor align perfectly with our strategic goals for the platform,” says Martin Stein, founder and managing partner of Blackford Capital. “With John’s leadership, we are poised to consolidate our current companies, maximize the incredible product lineup and channel expertise across the portfolio and ultimately expand our presence and deliver unparalleled value to our customers.”

Snowden’s appointment comes at a pivotal moment as Blackford continues to execute its consolidation strategy, designed to capitalize on demographic trends favoring outdoor home improvements, with the potential to capture even greater market share through strategic acquisitions, cross-selling synergies and a streamlined, customer-centric approach.

The consolidated companies provide a full spectrum of high-end outdoor products, including patio furniture, fire pits, artificial turf and more, through an omnichannel presence spanning e-commerce and dealer networks.

Mostly through mergers and acquisitions, the casual industry has seen and is going to be seeing a lot of news like this over the next few years.

In fact, over the past three years, several significant acquisitions have consolidated the industry — like Hearth and Home buying The Outdoor Greatroom Co., Best Buy acquiring Yardbird, Watson’s buying Allstate Home Leisure and Plank & Hide acquiring 300 South Main.

For this reason, it’s important to understand that consolidation will change the casual industry by creating competition. And that’s not a bad thing.

- Private equity can help companies thrive. These firms bring invaluable resources and cash to the table that can help any savvy business grow. The catch? The products need to be consistent with how they were pre-acquisition and the management team needs to know what they’re doing.

- Consolidation in business is natural. Whether it’s to create efficiencies or gain expertise in a category at a rapid pace, businesses in nearly every industry consolidate for one reason or another. The reason it matters so much in the casual industry is because of the shrinking amount of specialty retail stores and growing amount of full-line and e-commerce resources.

- There’s more consolidation to come. Over the next five years, consolidation will continue in the industry as the outdoor category continues to grow. If it hasn’t already, casual furniture will become a category as regular as case goods or sofas to some full-line manufacturers, and retailers who don’t carry outdoor will realize the giant hole in their product mix. And that’s a good thing for the entire category.

With more consolidation comes more competition, which is healthy for any industry, but it will make it more critical than ever to stand out.